Standing in line at the ATM, I overheard a frustrated conversation. A man complained bitterly about his bank’s unreliable network, and how he was forced to use a different ATM. Suddenly, a stranger appears, offering a helping hand. Trusting the stranger, who he mistook for the bank’s security guard, he handed over his card and went to use the restroom, the “trusted stranger” stole a whooping sum of 1.2 million naira and disappeared before he could come back!

This unsettling encounter leaves one shaken, a stark reminder of the dangers lurking in everyday transactions. So many individuals have refused to own ATM cards because they do not want their details stolen and their savings wiped off

Digital cards are quite beneficial; from easy online purchases to seamless international transactions. However, with the rise of cyber threats, security remains a top concern for many users. How do virtual dollar cards protect your transactions? What makes them a secure choice in the digital world?

Let us take a look at the world of virtual dollar cards and examine the innovative features that keep your transactions safe, ensuring you never fall victim to a similar story. We will also explore the security features that make virtual dollar cards a reliable choice for your financial transactions.

Security Features of Virtual Dollar Cards

Imagine you’re planning a trip abroad. You need a secure way to make purchases in foreign currencies without carrying large amounts of cash or risking your physical credit card being compromised. A virtual dollar card can be the perfect solution. They are designed with advanced security measures to protect your transactions and personal information, providing peace of mind whether you’re shopping online or travelling internationally.

- Advanced Encryption Technology

One of the primary security features of virtual dollar cards is advanced encryption technology. Advanced encryption standards (AES) are commonly used, providing a high level of security that makes it extremely difficult for hackers to decrypt your data.

Encryption converts your data into a code to prevent unauthorised access. When you make a transaction with a virtual dollar card, your information is encrypted, ensuring that it cannot be easily intercepted or deciphered by cyber criminals. This level of security is similar to what banks use to protect sensitive information, making virtual dollar cards a safe option for online transactions.

- Two-factor authentication (2FA)

To add an extra layer of security, many virtual dollar card providers use two-factor authentication (2FA). This involves something you know, like entering your password or verifying your identity through a second method, such as a code sent to your phone or an authentication app and sometimes something you are (biometric verification like a fingerprint)

This significantly reduces the risk of unauthorised access, as even if someone manages to obtain your password, they would still need the second form of verification.

- Real-Time Transaction Alerts

Virtual dollar cards often come with the feature of real-time transaction alerts. You’ll receive an instant notification on your mobile device or via email whenever a purchase is made using your virtual card. This allows you to monitor your account activity closely and immediately detect any unauthorized transactions. If you notice any suspicious activity, you can quickly report it and take steps to secure your account.

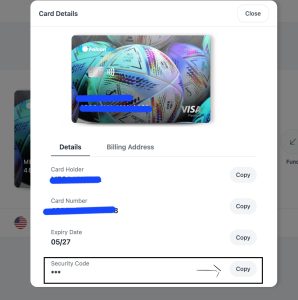

- Dynamic CVV

CVV is the 3-digit number on the back of physical credit cards, used to verify online transactions. Some virtual dollar cards offer a dynamic CVV (Card Verification Value) feature, where the CVV code changes periodically. Falconlite, for instance, issues a virtual dollar card with its CVV covered, with only the option to copy and paste. By constantly changing the CVV, or in the case of Falconlite, with its CVV permanently covered, it becomes much harder for fraudsters to use stolen card information for online purchases, adding an extra layer of security.

- Virtual Card Numbers

Some virtual dollar card providers give the option of generating virtual card numbers for specific transactions or merchants. These temporary card numbers can be used for a single purchase or for a limited time, reducing the risk of your actual card number being compromised. If a virtual card number is stolen, it cannot be used for other transactions, protecting your primary card details from fraud.

- Comprehensive Fraud Monitoring

Most virtual dollar card providers employ sophisticated fraud monitoring systems that use artificial intelligence and machine learning to detect unusual patterns of activity. These systems use machine learning and artificial intelligence to interpret transaction patterns and detect unusual activity. If a transaction appears suspicious, the system can flag it for review or automatically decline it, preventing potential fraud before it happens. By leveraging advanced technology, these systems can quickly respond to threats and keep your account secure.

- Secure Online Portals and Apps

Accessing your virtual dollar card through secure online portals and mobile apps adds another layer of protection. These platforms use secure socket layer (SSL) encryption to safeguard your information during login and transaction processes. Additionally, reputable providers regularly update their security protocols to combat emerging threats and ensure that their systems remain secure.

- Tokenization

Tokenization is another critical security feature used by virtual dollar cards. This process replaces sensitive card information with a unique identifier or token, that has no exploitable value outside of the specific transaction. Even if a cybercriminal gains access to the token, it cannot be used to extract your actual card details, thus protecting your account from fraudulent activities.

- Lock and Unlock Features

Virtual dollar cards often include features that allow you to instantly lock and unlock your card through a mobile app. If you suspect any suspicious activity or simply want to pause your card’s usage for added security, you can easily lock the card or ask your service provider to temporarily deactivate your card.

When you’re ready to use it again, you can just as quickly unlock it. This control over your card’s status provides an additional safeguard against unauthorised use.

Limitations of Virtual Dollar Cards

While virtual dollar cards offer numerous advantages, it’s essential to be aware of their limitations to make informed decisions.

- Limited Acceptance

Not all merchants and service providers accept virtual dollar cards. Some may require a physical card for verification purposes or may not be set up to process virtual card numbers. This limitation can be particularly inconvenient when trying to use the card for certain online services or subscriptions that mandate physical card details.

- Dependence on Technology

Virtual dollar cards rely heavily on technology, including internet access and digital devices. If you lose your smartphone or have no internet connection, accessing your virtual card can be challenging. Additionally, technical glitches or app malfunctions can temporarily restrict access to your funds.

- Potential Fees

While virtual cards often boast lower fees compared to traditional cards, they are not entirely free of charge. Users might encounter fees such as currency conversion fees, transaction fees for specific types of purchases, or fees for generating multiple virtual card numbers. It’s important to understand the fee structure of your virtual card provider to avoid unexpected costs.

Related: Virtual Account Fees and Hidden Costs to Watch Out For

- Limited Customer Support

Some virtual card providers offer limited customer support, which can be tiresome if you encounter issues with your card. Unlike traditional banks with extensive customer service teams, digital-only providers might offer support only via email or chat, potentially leading to slower resolution times, and this often discourages or puts off users.

- Security Concerns

Virtual dollar cards usually come with advanced security features, but they are not entirely immune to cyber threats. Phishing attacks, malware, and other cyber threats can still compromise your virtual card details if you’re not careful. Always ensure that you are using secure networks and keep your software updated to minimize risks. In addition, make sure to use a trusted service provider. Service providers with bad reputations are a high risk.

The Benefits of Using a Virtual Dollar Card in Nigeria

Virtual dollar cards offer a range of robust security features that make them a secure choice for online and international transactions. From advanced encryption and two-factor authentication to real-time alerts and dynamic CVVs, these cards are made to protect your financial information and give you peace of mind.

As you navigate the digital financial world, understanding and using these security measures can help you keep your transactions safe and secure. By choosing a virtual dollar card with strong security features, you can enjoy the convenience of digital transactions without compromising on safety. Whether you’re shopping online or travelling the world, your virtual dollar card can be a trusted companion in managing your finances securely. Stay updated, stay secure, and enjoy the convenience of digital finance with peace of mind.

[…] Security Features of Virtual Dollar Cards: Keeping Your Transactions Safe […]